EM Credit in 2024: investors can no longer ignore its attractiveness

By Andranik Safaryan, Portfolio Manager at the Emerging Markets/Corporate Debt team at Mainfirst

After a very difficult 2022 and a rollercoaster in 2023 for fixed income markets, we believe that the worst is now behind us and that 2024 will be very favourable for bonds in general and for Emerging Market credit in particular.

Positive inflation developments and the ongoing economic slowdown mean that central banks will be much more sensitive to growth risks and have a significantly higher hurdle for potential hikes of policy rates. Current yields are historically high and also compare favourably with equity valuations. Fixed income should therefore be the asset class of choice in a late-cycle scenario. Within the fixed income universe, we believe all the stars are aligned for Emerging Market (EM) credit to shine in 2024. We expect sentiment towards the asset class to change after two years of outflows. Peak Developed Market (DM) policy rates will translate into further USD weakness, which historically correlates with positive sentiment towards EM assets. EM credit offers a positive yield pick-up relative to DM credit, with much better fundamentals (lower corporate leverage than US and EUR credit). Idiosyncratic stories such as China’s real estate crisis and the conflict in Ukraine remain unsolved, but the universe has been through two years of cleansing and most names have already defaulted and bottomed out. EM corporates also benefit from their exposure to commodities, which are largely produced in EM countries. Commodity prices have both short-term and long-term tailwinds and the global appetite for commodities is here to stay, helping EM asset valuations.

2023 has been a year of disinflation. However, this has been slower than many – including central banks – expected, resulting in very poor monetary policy forward guidance and very high interest rate volatility. Despite this, the major credit markets were able to end the year in positive territory, with tighter spreads and high carry compensating the negative impact of rising interest rates. The situation now is different from what we had at the beginning of 2023.

Key drivers for fixed income in 2024

- Government bond yields are at historically high levels. At the short end, 2-year Treasury bonds currently have a yield of 4.94% after rising by more than 50 bps since January, a level not seen since 2007. This seems attractive considering short-term inflation expectations and the fact that a first rate cut is not priced in until late Q2 next year. At the long end, the 10-year Treasury yield is currently trading at 4.44% after rising almost 60 bps YTD, the highest level since 2007.

- Central banks have approached the end of the tightening cycle.

- Inflation has been coming down and the risks to growth increasing. We believe we are in a late-cycle scenario, which bodes well for fixed income products. While recent inflation figures are still above the targets set by the Fed, ECB and BoE, the visible slowdown in economic growth makes further hikes in 2024 unlikely. While the slowdown is more visible in Europe and the UK, and less so in the US, the sharp tightening of financing conditions will sooner or later impact SMEs and consumers, two sectors that have been resilient. The cost of short-term loans to SMEs has risen sharply, and delinquencies on credit cards and car loans are on the rise, highlighting emerging stress in some areas of the consumer sector as well. These are all indications of a late-cycle economy, which significantly raises the bar for further hikes, making them unlikely. The markets have therefore started to price in a cut as the next move.

- Historically high yields in fixed income products are being met by expensive equity valuations. While we acknowledge that non-cheap valuations do not necessarily lead to a correction and that a slowdown in earnings is not good for corporate bonds either, we believe that fixed income is a safer play in 2024 as it can benefit from its duration component and the repricing to higher yields that has occurred over the past two years.

Why we are enthusiastic about emerging market corporate bonds

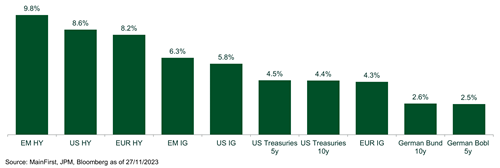

- Attractive valuations in both absolute and relative terms. Despite the positive year for risk assets and the November rally, valuations are not compressed as EM credit spreads trade around the 65th historical percentile at 357 bps. Historically, when spreads were around that level, the 12-month forward return was just above 6%. However, we expect it to be higher due to the exceptional repricing of yields over the past two years. EM credit also offers a higher yield than US and EUR credit, as shown in the figure below. Relative valuations are particularly attractive vs US credit, where the spread differential in IG and HY is around the 88th and 95th historical percentiles.

- Emerging Market corporates foot on strong fundamentals. Attractive valuations go hand-in-hand with strong fundamentals. The widening of spreads over DM credit is not due to deteriorating credit fundamentals, as EM corporates are less leveraged than their US and European peers. EM corporates deleveraged in the pre-pandemic years and benefited from the strong commodity recovery. Current net leverage (net debt/EBITDA) is 1x for EM IG companies (vs 2.8x for US and EUR corporates). For EM HY corporates, net leverage is 2.1x, much lower than for US and EUR corporates at 3.5x and 4.5x respectively. Long-term default rates in EM HY are similar to US HY at around 5.4%, even including the impact of the Russia/Ukraine conflict. While recent default rates and investor sentiment have been affected by idiosyncratic stories such as the Chinese property crisis or the conflict in Ukraine, the universe has already been through years of corrections and many names have already defaulted, limiting the additional negative impact on investors. We believe that EM corporates are well positioned to weather the downturn as many have very strong balance sheets.

- EM economies benefit from lower debt levels and younger populations. In many DM countries, growth prospects are subdued, especially after the sharp rise in debt following the pandemic. Countries such as Japan and Germany saw double-digit increases in their debt/GDP ratios after the pandemic. At the same time, many EM countries, particularly in LATAM and the Middle East, have seen their debt levels rise only modestly (largely due to their position as net commodity producers). Countries such as Brazil and Mexico have seen little change in their debt levels compared to pre-pandemic levels. Long-term factors such as a younger and growing population favour EM economies over developed countries, where the population is shrinking.

- Exposure to commodities is a huge driver in both the short and long term as the world consumes more energy, metals and food. A large proportion of these commodities are produced in EM. Both the oil & gas and metals & mining sectors have experienced many years of underinvestment. While CAPEX has rebounded in 2022/2023, it is still well below the peak reached in 2013. At the same time, inventories of both oil and metals are at historically low levels. The tight supply of metals is coupled with increasing demand, driven by the green transition. Population and economic growth are further arguments for increasing demand, especially from rising economies such as India, where per capita consumption of commodities is well below that of the DM economies. Demand for commodities is high and will continue to rise. Emerging economies are those that benefit most from this trend as they are the largest producers. In a booming commodities environment, emerging markets significantly outperform developed markets.

- Lower interest rates will drive USD weakness, which is positively correlated with sentiment and returns on EM assets. While many EM countries are less vulnerable to the USD than in the past, given the development of local debt markets, USD weakness usually tends to be correlated with positive investor sentiment towards EM assets and inflows into the asset class. As interest rates fall in line with a weaker economic outlook and markets raise expectations of rate cuts, the USD weakens. We expect inflows into the asset class as the outflows of the past two years have created very attractive opportunities within the EM corporate universe. At the same time, we expect the supply of new bonds to remain limited next year, which also makes the technical backdrop very attractive.